PAN Card and Aadhaar Linking is important so link your PAN Card with Aadhar Card Number Before Deadline.

If you hold a PAN and are eligible to get Aadhaar or already have an Aadhaar number, you must inform the income tax department. You can do this by linking your PAN to your Aadhaar. If you fail to do PAN-Aadhaar linking, your PAN will become ‘inoperative’. So let’s know how to link PAN with Aadhaar Card Number.

The last date for linking Aadhaar with PAN was 31st March 2022. PAN will become inoperative from 1st April 2023 if it is not linked with Aadhaar.

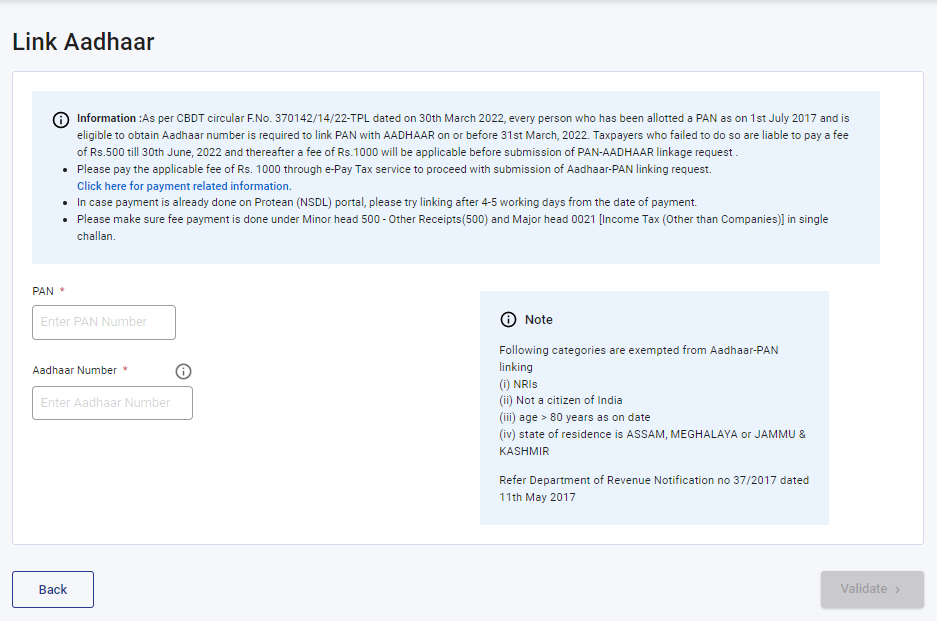

*Information: As per CBDT circular F. No. 370142/14/22-TPL dated on 30th March 2022, every person who has been allotted a PAN as on 1st July 2017 and is eligible to obtain Aadhaar number is required to link PAN with AADHAAR on or before 31st March 2022. Taxpayers who failed to do so are liable to pay a non-refundable fee of Rs. 500 till 30th June 2022 and thereafter a fee of Rs. 1000 will be applicable before submission of PAN-AADHAAR linkage request.

Please pay the applicable non-refundable fee of Rs. 1000 through e-Pay Tax service to proceed with submission of Aadhaar-PAN linking request. Click here for payment related information. Click here for payment related information.

In case payment is already done on Protean (NSDL) portal, please try linking after 4-5 working days from the date of payment.

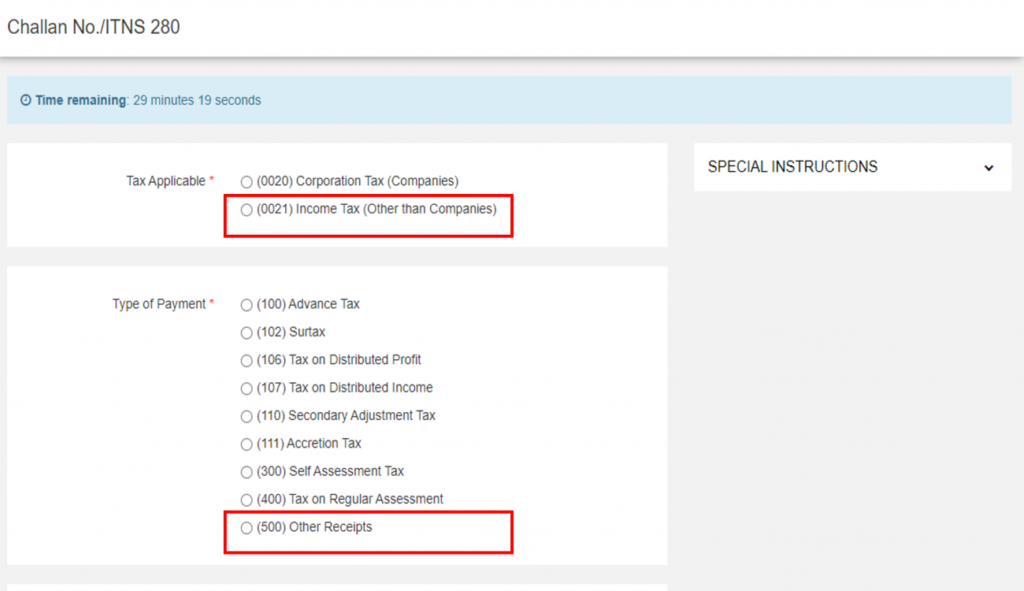

Please make sure fee payment is done under Minor head 500 – Other Receipts(500) and Major head 0021 [Income Tax (Other than Companies)] in single challan.

How to link your PAN to your Aadhaar?

Two main steps for linking your Aadhar with your PAN:

- Submit the Aadhaar-PAN link request.

- Payment of fee on NSDL portal under Major head (0021) and Minor head (500) for AY 2023-24.

Documents to keep handy:

- Aadhaar Card

- PAN Card

- Mobile number linked to Aadhaar

1. Submit Online/Offline Requests for Linking of Aadhaar Number and PAN

You can do online linking of the Aadhaar number with your PAN by logging on to the Income Tax e-filing portal. You can also do it through SMS. There are three ways of linking your PAN to your Aadhaar:

Method 1: Linking of Aadhaar Number and PAN via SMS

Now you can link your Aadhaar and PAN through SMS. The income tax department has urged taxpayers to link their Aadhaar with their PAN, using an SMS-based facility. It can be done by sending an SMS to either 567678 or 56161. Send SMS to 567678 or 56161 from your registered mobile number in the following format: UIDPAN<SPACE><12 digit Aadhaar><Space><10 digit PAN>

Example: UIDPAN 123456789123 AKPLM2124M

Method 2: Without Logging in to Your Account (2 Step Procedure)

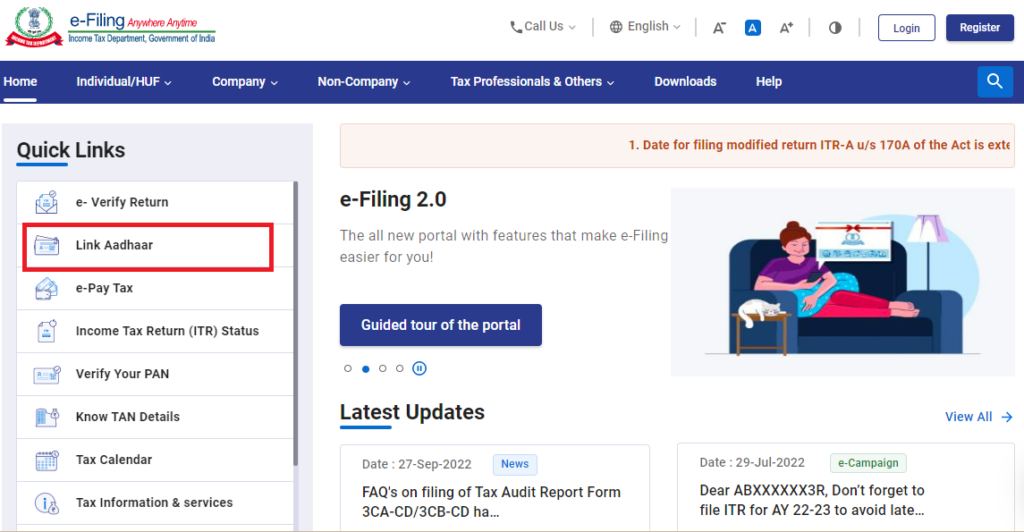

Step 1: Go to the Income Tax e-filing portal. Under quick links, click on the ‘Link Aadhaar’ tab.

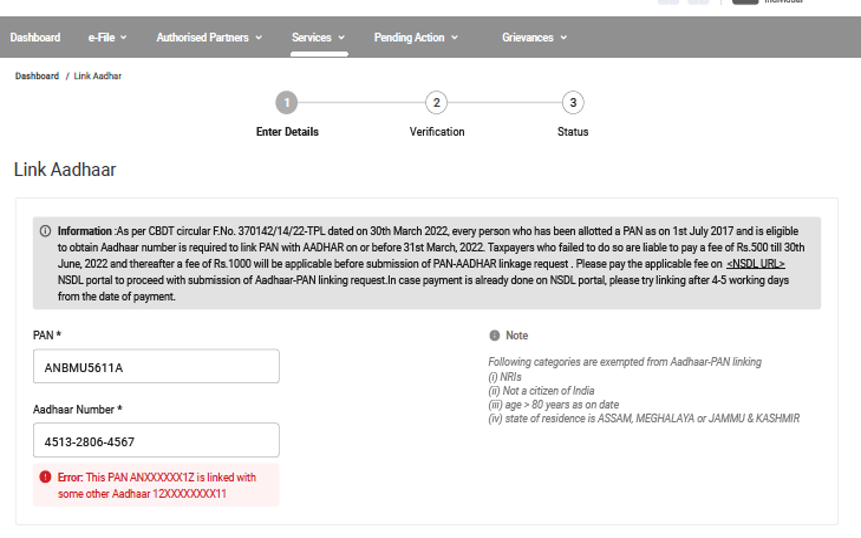

Step 2: Enter your PAN and Aadhaar number

Step 3: Note that if PAN is linked to another Aadhaar, you will see an error that reads ‘PAN is already linked with another Aadhaar’.

2. Payment of fee on the NSDL portal

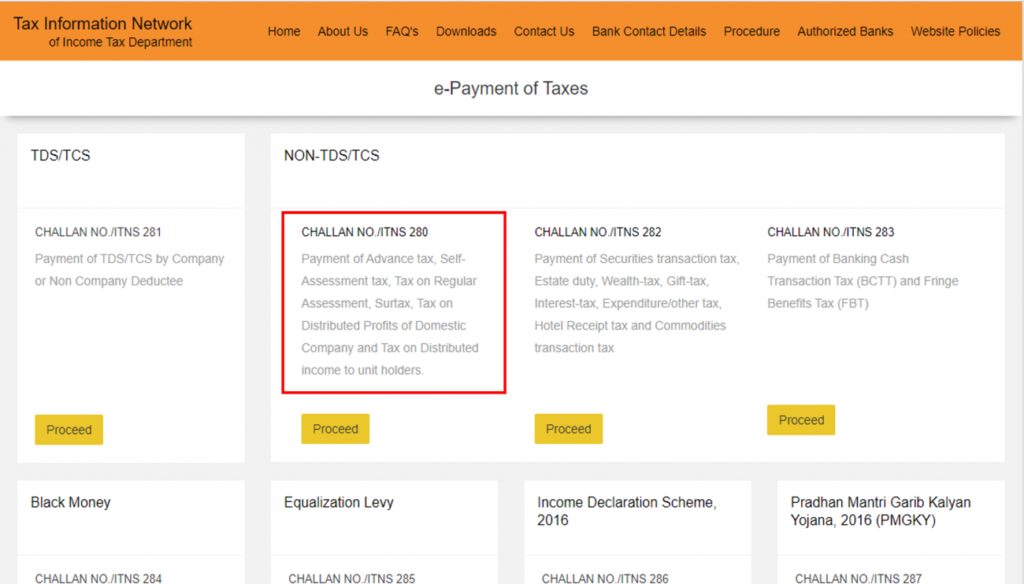

Step 1: Go to the tax payment page and select Challan no./ITNS 280 under the Non-TDS/TCS category.

Step 2: On the next screen, select head ‘(0021)’ and then ‘(500)’

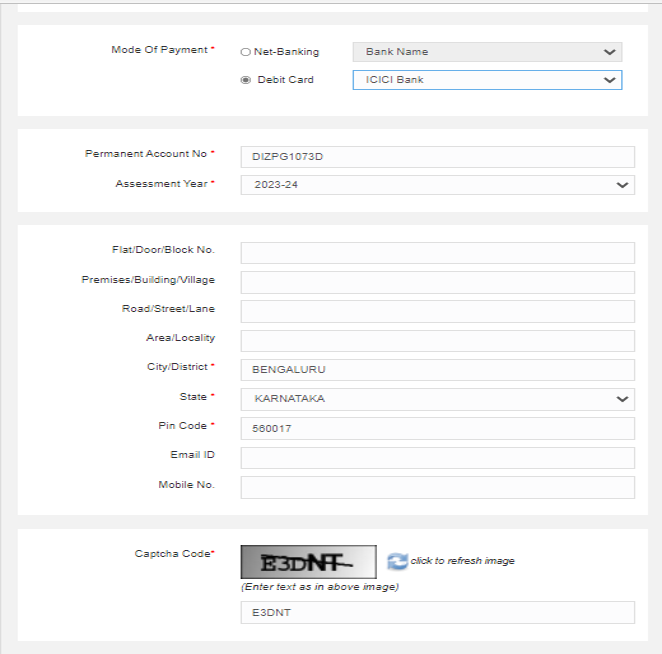

Step 3: Scroll down to select the mode of payment and enter the required details (like your PAN, for Assessment Year select 2023-24, address, etc.)

Step 5: Proceed to make the payment and follow the next steps to submit the PAN-Aadhaar link request. It is advisable to wait 4-5 days before submitting the request.

Frequently Asked Questions

While trying for PAN-Aadhar linking, I got a message that the authentication has failed. What should I do?

The authentication fails due to a mismatch in the data between your PAN and Aadhaar. You can check for the correctness of the data such as name, date of birth, and mobile number, amongst others.

How do I link PAN and Aadhaar if there is a mismatch in name or date of birth?

To Initiate the Aadhaar linking process, enter your PAN and Aadhaar number, your name, date of birth and mobile number details as per your Aadhaar card; the income tax department will send an OTP on the registered mobile number to enable the linking. In the case of a mismatch in the date of birth, you need to update your Aadhaar card data.

Write with us✍?

Greetings to Everyone from TeamUgtWorld! Anybody who wants to write whatever his/her Heart wants to. They can now publish their content with us on our platform @Ugtworld. For more information click on the following link…